Tipalti is considered the world’s most powerful and professional payment platform designed to make your payment and payout experience as easy as possible.

In order to receive payment, please complete the short payee registration process. Please visit the Vydia Dashboard to submit your payee registration information and payment details.

DISCLAIMER: Tipalti/Vydia is not authorized to provide tax advice. Any tax-related information posted on this website is not intended and should not be construed as tax, legal or investment advice. If you have questions about tax-related issues, please consult with a tax professional.

Who are eligible for Tipalti payments?

A Vydia account holder needs to meet the minimum threshold of $35 in lifetime earnings to be eligible for payments from Vydia. Payees are not considered payable by the Tipalti system until all electronic tax forms have been submitted and all manual tax forms, explanations and additional documents (if required) have been received and approved.

What benefits do you get by registering today?

- Faster and automated payments with one-time setup.

- The flexibility to choose from various payment methods and currencies to receive your earnings.

- Enterprise-grade security that ensures your payment information is safely maintained at the highest security level available.

What types of payment methods are available?

We currently offer ACH (US), Wire Transfer (US), International ACH (e-check), Paper Checks, and Paypal.

What types of currencies will I get paid?

Most major currencies are available. After you select your geography on the onboarding page, it will show the currency applicable for that market. This typically defaults to the standard currency in that particular region.

How long is the processing time?

Vydia distributes your payout once a month after the receipt of payments from partner networks. These payouts typically occur during the middle of the calendar month. The time it takes for the funds to arrive in your account depends on the payout method you have selected. After Vydia releases the payout, it takes additional time for the money to be delivered to you.

- Domestic ACH: Up to 3 business days

- Bank transfer or international wire: 3–7 business days

- Paper Checks: 3-7 business days

- PayPal: Within 1 business day

Weekend or holiday delays:

Most banking systems don’t process transactions on weekends or holidays. If your payout from Vydia is completed between Friday and Sunday, it may be delayed and processed the following week.

What kind of currencies are available for each country and payment method?

The following table lists supported payment methods for each country on the Tipalti Solution when the funding currency is US dollars (USD). “T” refers to the Value Date assigned by the bank to a payment instruction.

Click Here for Full List of Countries

Why can I not request withdrawals any more?

Monthly earnings will be disbursed at the end of each month via your payment method of choice, after we receive payments from our network partners.

What are the fees for the payments?

| ACH (US only) | USD $1.15 |

| Check | USD $3.45 |

| eCheck (international) | USD $5.75 |

| eCheck (Local UK bank account only) | USD $1.72 |

| PayPal (Non-US Resident) | USD $1.15 + 2% Up to USD $21.15 |

| PayPal (US Resident) | USD $1.15 + 2% Up to USD $2.15 |

| Wire Transfer (Non-US resident paid in non-USD) | USD $23.00 |

| Wire Transfer (Non-US resident paid in USD) | USD $29.90 |

| Wire Transfer (US resident) | USD $17.25 |

| Foreign Exchange Rate | 2.50% |

Our partner payment platform Tipalti charges a fee for each transaction, which is automatically deducted from the payout. Vydia does not charge any additional fees for payments. You will be informed of the fees charged based on the payment method you select, before proceeding to the next step.

If any of the circumstances below occur and a payment sent through Tipalti is rejected or taken under compliance review, a rejection or review fee may be charged to Vydia by Tipalti. Should such a fee be charged, the related Vydia user(s) account balance shall be debited by the full amount of any such fee(s):

- A user provides incorrect or invalid payee details, including but not limited to SWIFT number, routing number, bank account number, PayPal account information, and/or check information

- A payee’s bank and/or PayPal rejects any payment(s) due to reasons specific to the payee’s geographic region

- A payee triggers an Anti Money Laundering (AML) and/or Office of Foreign Assets Control (OFAC) review

- Any reason outside of the control of Vydia

What other fees could I incur?

- Failed transactions due to incorrect payment information under the updated content licensing agreement will be deducted from your account balance in addition to transaction fees (see: What are the fees for these payments?)

- For international accounts, we strongly recommend that you reach out to the receiving institution to ensure your account is able to receive payments in your selected method and that your account is in good standing.

***International Paypal users should call Paypal customer service to verify they are able to receive payments. We have noticed an increased number of regions that are limited to sending money and cannot receive payments.****

Fee Schedule

| Wire Investigations | $25.00 each |

| Check Stop Payments | $35.00 each |

| Check Photocopies | $20.00 each |

| US ACH Return Fee | $11.00 each |

| eCheck Return Fee | $25.00 each |

| Wire Return Fee | $25.00 each |

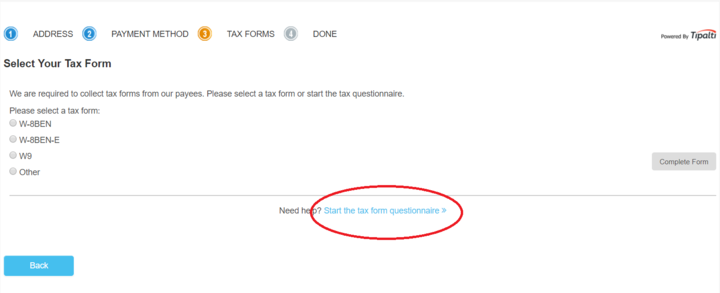

Tax Questionnaire Flow

Payees can complete the following questionnaire to determine which tax form they are required to submit. Tipalti suggests the relevant tax form based on the payee’s answers to the questions below. Answers are not saved in the system. Therefore, if payees exit the questionnaire before completion, they will have to restart the questionnaire.

| # | Question | IF YES | IF NO |

| 1 | Are you an individual? | Go to #2 | Go to #3 |

| 2 | Do any of the following apply to you?

|

W-9 (use our wizard) | Go to #4 |

| 3 | Is the entity incorporated in the US? | W-9 (use our wizard) | Go to #5 |

| 4 | Is your income effectively connected with the conduct of trade or business within the US? | W-8ECI | Go to #6 |

| 5 | Is the entity a foreign partnership, a foreign simple trust or a foreign grantor trust (and not claiming treaty benefits)? | W-8IMY | Go to #7 |

| 6 | Are you acting as Intermediary? | W-8IMY | Go to #8 |

| 7 | Is the income of the entity effectively connected with the conduct of trade or business within the US? | W-8ECI | Go to #9 |

| 8 | Are your receiving a compensation for personal services performed in the US for which you are claiming a treaty benefit? | 8233 | W-8BEN (use our wizard) |

| 9 | Are you representing a foreign government, an international organization, a foreign central bank of issue, a foreign tax-exempt organization, a foreign private foundation or government of a US possession claiming the applicability of section(s) 115(2), 501(c), 892, 895 or 1443(b)? | W-8EXP | W-8BEN-E (use our wizard) |

Electronic Tax Forms

Tax forms that are completed using Tipalti’s online wizard do not require your approval before submission. The information the payee enters on the tax form is cross-checked with the type of tax form. For example, if the payee completes a W-8BEN or W-8BEN-E form, the system checks that the payee’s permanent resident address, mailing address, country and phone number are ex-US.

Manual Tax Forms

You must review and approve manually completed tax forms on the AP Hub (via the Documents tab or the Payees > Documents subtab [see Find Payee Documentation]).

W-9

The W-9 form should be completed by the payee if the payee entity is incorporated in the US or the payee is an individual and one of the following applies:

- The payee is a US citizen.

- The payee is a resident of the US.

- The payee has dual citizenship with one citizenship being US.

- The payee is subject to taxation as a US citizen.

- The payee was born in the US and has not formally renounced US citizenship.

The W-9 form can be completed by the payee via Tipalti’s online wizard.

W-8BEN

The W-8BEN form should be completed by the payee if the payee is an individual who is NOT:

- A US citizen

- A resident of the US

- Subject to taxation as a US citizen

- US born

And who:

- Has no income effectively connected with the conduct of trade or business within the US

- Is not acting as Intermediary

- Is not receiving a compensation for personal services performed in the US for which the payee is claiming a treaty benefit

The W-8BEN form can be completed by the payee via Tipalti’s online wizard. Here are instructions on how to complete the form.

W-8BEN-E

Non-US entities that have US-sourced income are required to complete the W-8BEN-E form. This form can be completed by the payee via Tipalti’s online wizard. Instructions on how to complete the form are also provided.

Note: Starting from November 1, 2016, all payees must complete a new version of the W-8BEN-E form due to the following changes in the form. A new entity type, International Organization, and Limitation on Benefits (LOB) provisions have been added.

W-8ECI

The W-8ECI form should be completed if the payee is an individual and the payee’s income is effectively connected with the conduct of trade or business within the US. The W-8ECI form and instructions on how to complete the form are provided to the payee. This form must be downloaded, completed manually and uploaded back to the Payee Dashboard or Suppliers Portal.

W-8IMY

The W-8IMY form should be completed if the payee entity is a foreign partnership, a foreign simple trust or a foreign grantor trust (and not claiming treaty benefits) or the payee is an individual acting as Intermediary. The W-8IMY form and instructions on how to complete the form are provided to the payee. This form must be downloaded, completed manually and uploaded back to the Payee Dashboard or Suppliers Portal.

W-8EXP

The W-8EXP form should be completed if the payee is representing a foreign government, an international organization, a foreign central bank of issue, a foreign tax-exempt organization, a foreign private foundation or government of a US possession claiming the applicability of section(s) 115(2), 501(c), 892, 895 or 1443(b); and, the following applies:

- The payee is not an individual.

- The payee is not an entity incorporated in the US.

- The payee is not an entity that is a foreign partnership, a foreign simple trust or a foreign grantor trust (and not claiming treaty benefits).

- The income of the payee entity is not effectively connected with the conduct of trade or business within the US.

The W-8EXP form and instructions on how to complete the form are provided to the payee. This form must be downloaded, completed manually and uploaded back to the Payee Dashboard or Suppliers Portal.

8233

The 8233 form should be completed if the payee is receiving compensation for personal services performed in the US for which the payee is claiming a treaty benefit. The 8233 form and instructions on how to complete the form are provided to the payee. This form must be downloaded, completed manually and uploaded back to the Payee Dashboard or Suppliers Portal.

Tax Forms Expiration

The following tax forms are valid for the year signed plus the three following calendar years. After this time, the forms expire automatically and payees are notified of the expiration via email. Seven days prior to the expiration, a tax form expiration notice advising you to submit a new form will be sent to you.

- W-8BEN

- W-8BEN-E

- W-8ECI

- W-8EXP

The 8233 form expires annually from the date signed and the W-8IMY and W-9 forms have no expiration.

Additional Documents

Depending on the type of US tax form and information entered by the payee, the payee may be required to provide additional documents for verification and / or an explanation as to why certain information was entered. The following table provides examples of when additional documents are required.

| US TAX FORM TYPE | TRIGGER FOR DOCUMENT REQUIRED | EVIDENCE REQUIRED | ACCEPTABLE DOCUMENTS |

| W-8BEN |

|

Evidence of non-US address / treaty address (only if treaty is being claimed) AND explanation of US address |

|

| W-8BEN-E |

|

Evidence of non-US status / treaty eligibility (only if a treaty is being claimed) |

|

| W-8BEN |

|

Evidence of treaty address |

|

| W-8BEN-E |

|

|

|

| W-8BEN-E |

|

Evidence of treaty address |

|

| W-8IMY | When the tax form is submitted | Withholding certificate AND withholding statement | Withholding certificate AND withholding statement |

If the payee has provided an explanation, the payer receives an email notification advising that the explanation can be reviewed on the AP Hub. Explanations and additional documents can be reviewed and approved (or rejected) on the Documents tab (or the Payees > Documents subtab; see Find Payee Documentation). If rejected, the payer must provide a reason for the rejection. An email notification containing the reason for rejection will be sent to the payee.

Once additional documents are approved by the payor, payees can view these documents in the Payee Dashboard or Suppliers Portal; however, they will be unable to remove documents. If payees upload another document of the same type, the previously uploaded document is replaced with the new document, which then requires approval.

Will I have to pay taxes on my earnings?

Vydia is required by United States tax laws to collect certain tax-related information. You may have to pay taxes on your earnings. It is your responsibility to understand and comply with any and all applicable tax laws. For specific information regarding U.S. tax requirements, please visit the IRS website or consult with a tax professional.

What if I don’t have a tax I.D.?

If you are a U.S. business or individual, or a non-U.S. business with U.S. Activities, as described on our Tax Information Page, and you do not have a tax I.D. such as a Taxpayer Identification Number or Social Security Number, you’ll need to acquire one. We suggest that you obtain your TIN as soon as possible. Please note that the process of obtaining a TIN may take several weeks. You can visit the Internal Revenue Service (IRS) website for more information on obtaining a U.S. TIN.

Non-US Residents: You will be prompted to fill out a W8-BEN form.

Am I subject to US Tax withholdings (non-US residents)?

You may be subject to US tax withholdings if you are not a US resident, and may be exempt if you are a resident in a country with a tax treaty.

For specific information regarding U.S. tax requirements, please visit the IRS website U.S. Tax Withholding on Payments to Foreign Persons.

What should I do if I cannot continue to the next screen or am having trouble filling out a form?

Our customer service team is readily available to help you with any questions or issues you may have during the registration/onboarding process. We will do our best to help you register/onboard to receive your payments.